The real cost of financial advice (and how firms can serve more clients for less)

Financial advice is too expensive.

Here’s how to fix it

For years, financial advice has been out of reach for many people. Not because they don’t need it, but because they can’t afford it. The average cost of advice is around £2,000 per case (Unbiased, 2023). That price point makes it difficult for firms to profitably serve clients who don’t have significant wealth, leaving many people without access to the financial guidance they need.

But what if that could change?

Why traditional advice costs so much

The financial advice model has long relied on manual processes and adviser time to deliver recommendations, handle compliance, and manage client onboarding. While this approach ensures tailored service, it also makes advice expensive and limits how many clients a firm can serve.

For many advisers, this creates a dilemma:

- High costs mean they must focus on high-net-worth clients to remain profitable

- Middle-income individuals, who need advice, are priced out

- The growing advice gap continues to widen

With rising regulatory expectations and increasing operational costs, firms need a new way to scale advice without inflating costs.

A low-cost advice proposition

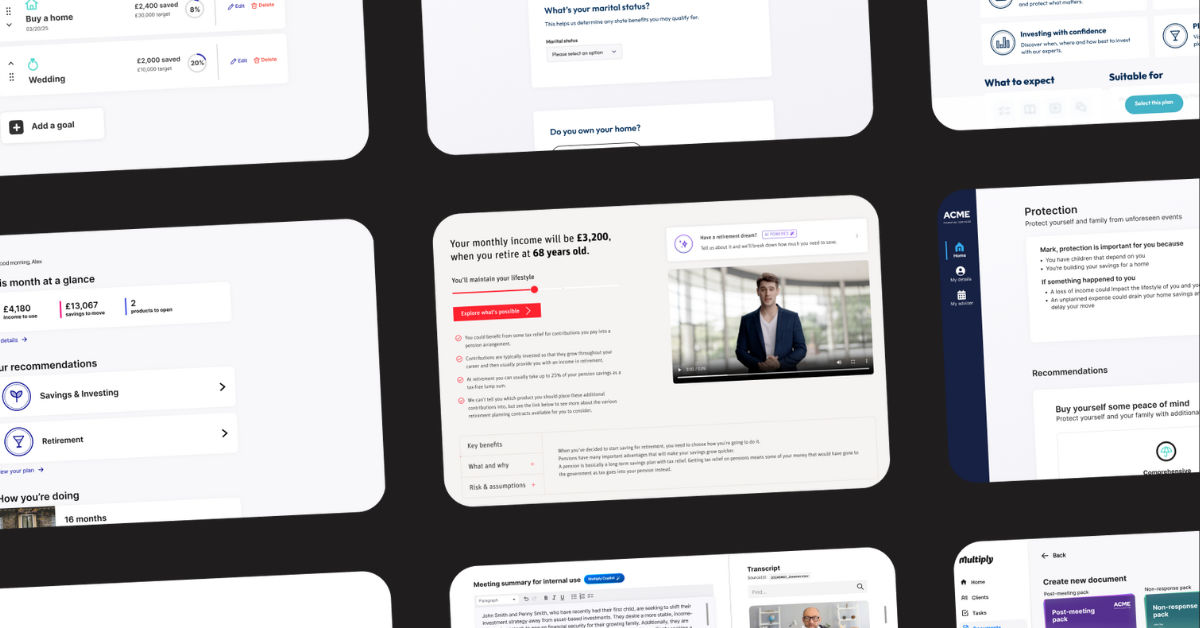

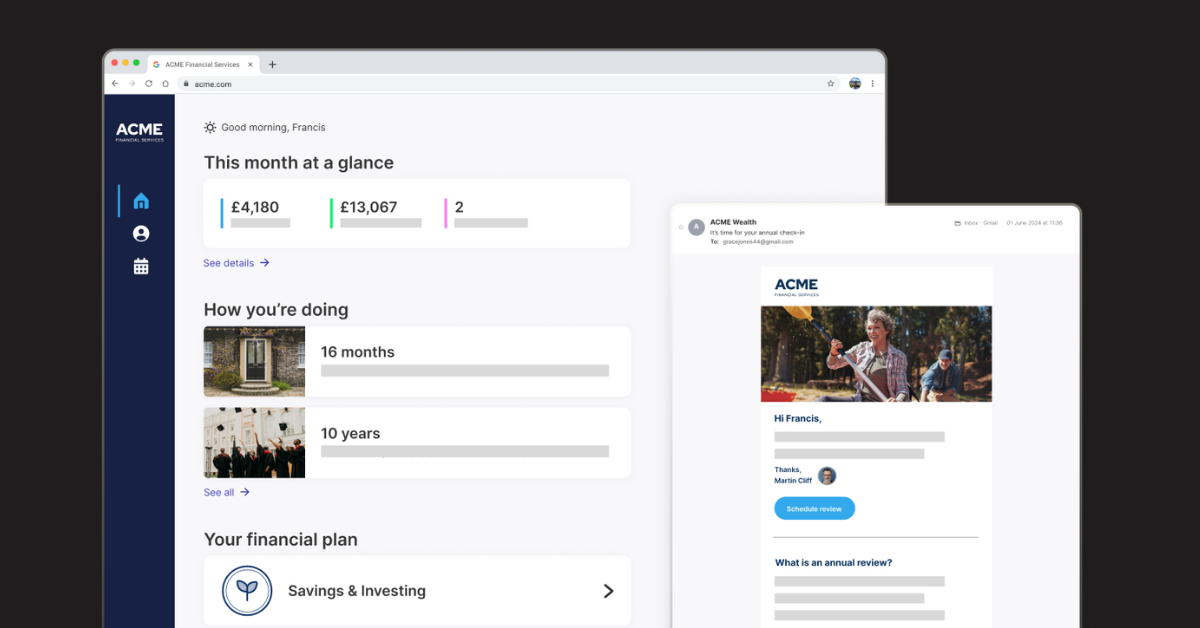

Multiply enables advice firms to reduce costs by up to 90% through automation and hybrid models. Instead of relying solely on adviser time, Multiply’s platform streamlines the advice process, making it possible to profitably serve all client segments.

Here’s how:

✅ Fully automated advice – Simple cases can be handled end-to-end with AI-powered workflows, reducing manual intervention

✅ Hybrid model for complex cases – When human expertise is needed, Multiply seamlessly integrates adviser oversight

✅ 80% less admin – Automated onboarding, risk profiling, and compliance mean less paperwork and more time with clients

✅ 3x more clients, same team – Scale without increasing headcount

✅ Consumer Duty support – Ensuring firms can deliver fair, accessible, and compliant advice

Scaling advice, not just cutting costs

The goal isn’t just cost reduction; it’s about expanding access to financial advice while keeping firms competitive and compliant. By removing inefficiencies, firms can:

- Serve previously underserved markets profitably

- Meet Consumer Duty requirements by offering fair and accessible advice

- Grow their client base without additional resource strain

Multiply doesn’t replace advisers; it empowers them. By automating routine tasks, firms can serve more clients while ensuring advisers focus on what they do best: building relationships and delivering expert advice.

The shift is already happening; are you ready?

Multiply is already helping firms reduce costs, scale advice, and reach more clients.

🚀 Want to see how it works? Let’s talk.