Revolutionising Financial Planning: The Benefits of AI Software for Banks and Wealth Management Firms

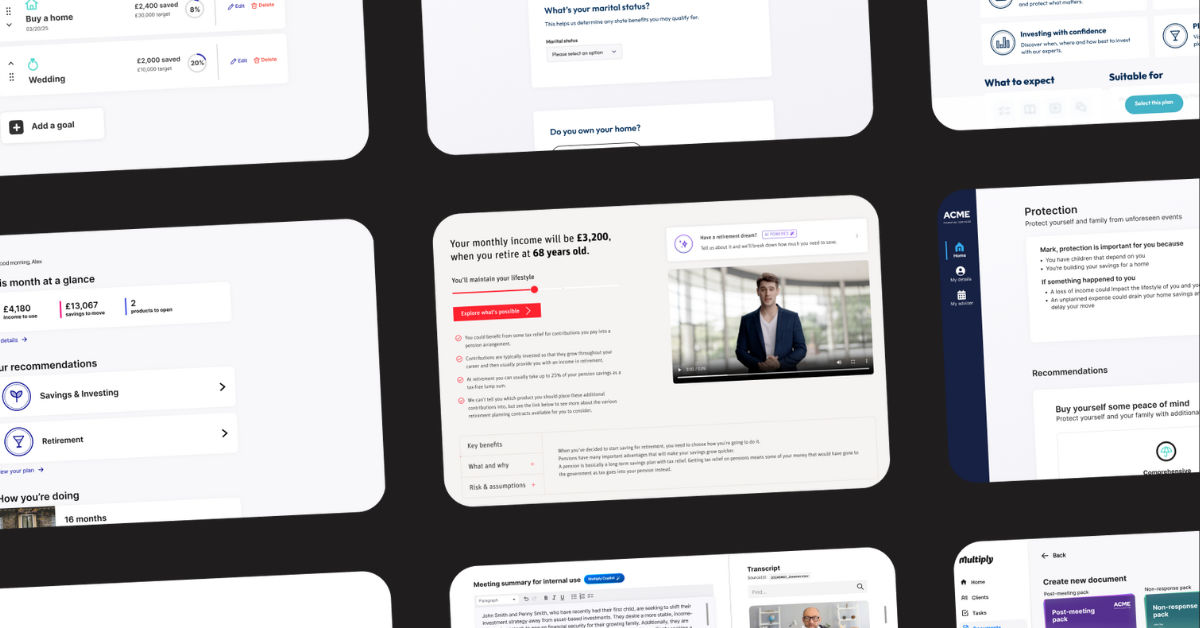

As the financial industry continues to evolve and become more digital, many banks and wealth management firms are turning to artificial intelligence (AI) to help improve their financial planning and analysis processes.

AI financial planning software offers a range of benefits to these organisations, including improved accuracy and efficiency, personalised financial advice, and cost savings.

In this blog post, we'll explore how AI financial advice software can help banks and wealth management firms excel in today's competitive marketplace. With our extensive experience using the technology at Multiply, we have a deep understanding of its potential to improve outcomes for end-users.

Improved accuracy and efficiency in financial planning and analysis

AI financial planning software can improve accuracy and efficiency in several ways. Some examples include:

Automating tasks: The software can automatically perform financial planning and analysis tasks, such as data entry, calculations, and report generation. This can help to reduce the risk of human error and ensure that the results are accurate.

Processing large amounts of data: AI algorithms are designed to quickly and accurately process large amounts of data, which can help banks and wealth management firms to make more informed decisions. The software can also identify trends and patterns in the data that may not be immediately apparent to human analysts.

Providing personalised advice: The software can use machine learning algorithms to provide personalised financial recommendations to clients, based on their individual circumstances and goals. This allows banks and wealth management firms to offer a wider range of tailored and effective advice to their clients, which can improve their ability to meet their financial goals. However, it's important to note that the complexity of advice varies, and while AI can provide recommendations across most of the spectrum, there are other considerations such as accurate data capture and risk management to consider, that can play a crucial role in the effectiveness of the recommendations. But with the capability of AI to analyze large amounts of data and make predictions quickly, it can be a valuable tool for financial institutions to stay competitive in the market and provide comprehensive advice to clients.

The ability to provide personalised financial advice to clients

AI financial planning software can provide personalised advice to clients throughout their lifecycle by using machine learning algorithms to analyse their individual financial situation and goals.

The software can take into account factors such as the client's income, expenses, assets, liabilities, and risk tolerance, as well as their short-term and long-term financial goals. Based on this analysis, the software can generate personalised recommendations and advice, such as investment portfolios, savings plans, and retirement strategies.

The software can also continuously monitor the client's financial situation and goals and adjust its advice accordingly. For example, if the client's income or expenses change, or if their financial goals evolve, the software can provide updated advice that takes these changes into account. This can help banks and wealth management firms to provide ongoing support and guidance to their clients throughout their entire lifecycle.

Cost savings

There are several ways that an AI financial planning software tool could help financial institutions save costs. Some examples include

Improved efficiency: By automating financial planning and analysis tasks, the tool can help banks to save time and reduce the number of staff needed to perform these tasks. This can lead to cost savings in terms of labour and other resources.

Enhanced accuracy: The tool can help banks to avoid costly mistakes or errors in financial planning and analysis by quickly and accurately processing large amounts of data. This can help to prevent losses and other financial problems, as well as ensure compliance with industry regulations. Automating advice also helps to reduce the risk of unsuitable recommendations which is a major concern for firms' risk and compliance teams. The tool can help financial institutions to adhere to rules or guidelines around advice that is provided, ensuring that the recommendations made align with industry regulations. By automating the process, financial institutions can not only improve the accuracy of their advice but also ensure compliance while reducing risk.

Greater customisation: The tool can provide personalised financial advice to clients, which can help to improve customer satisfaction and retention. This can lead to cost savings in terms of marketing and customer acquisition.

Helping keep banks and wealth management firms stay competitive in an increasingly digital marketplace

There are several benefits to staying competitive in any industry. These benefits can include:

Increased market share and revenue: By staying competitive, businesses can attract more customers and increase their market share, which can lead to higher revenue.

Improved customer satisfaction: Competitive businesses are often able to offer high-quality products and services that meet the needs of their customers, which can lead to increased customer satisfaction and loyalty.

Enhanced reputation and credibility: A business that is known for being competitive is often perceived as being a leader in its industry, which can enhance its reputation and credibility. This can make it easier for the business to attract top talent, as well as secure partnerships and collaborations with other organisations.

Greater innovation and agility: In order to stay competitive, businesses often need to be agile and adaptable, which can drive innovation and help them stay ahead of the curve. This can also help businesses to anticipate and respond to changes in the market, such as shifts in customer preferences or new technologies.

Overall, staying competitive can help businesses to grow and succeed in an increasingly competitive marketplace.

TL;DR

AI financial planning software can improve accuracy and efficiency by automating tasks, processing large amounts of data, and providing personalised advice. It can also help banks to save costs by improving efficiency, accuracy, customisation, and competitiveness.

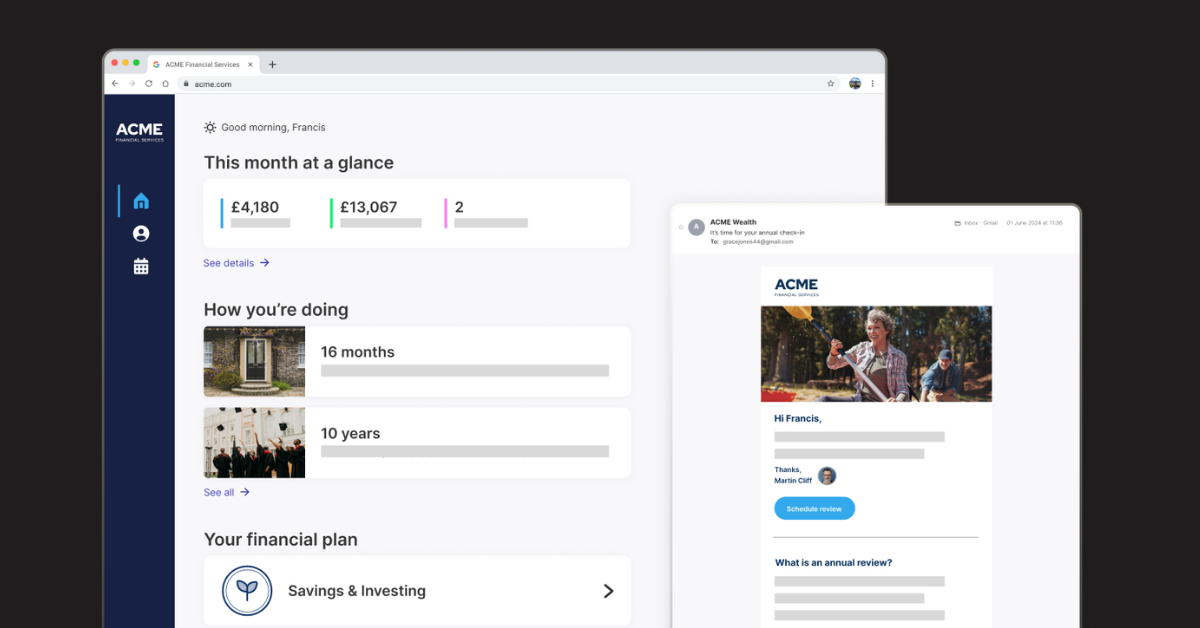

Multiply is currently working with Irish Life to help them integrate all of the above benefits into their business.

To learn more about what we do, contact us using the button below.