We generated over 250k digital advice recommendations (you can too!)

Back in 2019, Multiply was the first holistic financial advice app to get the FCA’s regulatory approval.

It was a huge achievement - nobody had fully automated financial advice before - and over the past three years we’ve given digital advice across pensions, investments, savings and insurance products.

Now with over 250,000 recommendations delivered, I want to share what we’ve learnt along the way. Here’s the good, the bad and the ugly of building a digital advice business and the lessons you can take from our journey.

Identify your experts

My background prior to Multiply was in derivative trading, while my co-founder Mike Curtis had been working on a PhD in astrophysics. This is us way back at the start of the journey, looking a lot more fresh-faced.

Neither of us had given financial advice before, but we’d both engaged with it and believed technology could revolutionise the industry. Clearly, we couldn’t achieve this vision alone though, so we tapped into the experience of people who knew the advice business best - financial advisers.

A key hire we identified in the early days was Peter Fairweather (that’s him in one of his many bright shirts above) who’s a financial adviser with over 25 years of experience. He gave us an immediate understanding of the operational and compliance aspects of delivering advice - two areas that can really keep you awake a night when you're trying to automate them.

It’s not just experienced advisers who’ve been essential to shaping our digital advice though. Behind our advice platform, there’s been product managers, designers, developers and copywriters, and all of these different skill sets have played a crucial role in building the technology we have now.

Pick your target market and build your advice rules

Defining our target market was key to creating digital advice that would scale. We accepted early on that we wouldn’t be able to help everyone, so we focused specifically on delivering plans to people within the 20-40 age bracket who had previously been neglected by the advice industry.

Once this target market was defined we needed to formulate the advice. There were two key methods that drove our decision-making here.

Create clear house views

The advice had to revolve around clear ‘house views’, which can be best described as the core principles driving our advice. These were the backbone of the advice engine within our consumer-facing app and latterly the solutions we’re now building for business clients.

Follow a cascading needs framework

We decided to deliver our advice through a series of priorities and allocations of both a customer's income and assets. Different objectives and goals are fed in different ways, with some areas being filled before others.

Our analogy-loving advisers describe it like the Trevi Fountain in Rome, where water cascades in several ways but the result is a perfectly designed structure. Only an adviser could look at the Trevi fountain on holiday and come up with that analogy.

Create a culture of collaboration

Everyone in the Multiply team will say it’s really powerful to mix advisers, engineers, product experts and designers in the same conversations. Doing so allows the right level of information transfer to occur, which will enable you to solve the challenging parts of the build down the line. And believe me, the challenges can be many.

During our time at Multiply, we’ve recruited a blend of advice veterans and rookies, and this has really helped with first principles thinking. When we'd come across complicated problems, such as correctly applying the Pension Annual and Lifetime Allowance rules within our advice engine, we broke down the challenges into their basic elements and then reassembled them from the ground up. This allowed us to reverse-engineer complicated problems and unleash creative possibilities.

When doing this exercise our advice rookies often offered fresh perspectives, showing that a lack of experience can be seen as a help rather than a hindrance.

This constant collaboration amongst the Multiply team has led to the cross-pollination of ideas, which is vital when you’re trying to disrupt an industry and provide digital advice at scale.

Never stop testing, and your advice will never stop improving

Get financial advice wrong and not only will your customers suffer, but you could face prison too.

Three years on from launching our app though I’m glad to say none of us are behind bars, in fact, we’ve not even had one advice complaint amongst our 250,000 recommendations.

I’d put this down to rigorous testing, which was key to getting our FCA approval and allowing us to confidently unleash advice at scale.

When planning our testing we regularly thought of the extremes, as these are often the areas that create the problems. However, don’t let the extremes become an obsession and don’t focus too much on the edge cases, as this will limit your ability to digitise your advice.

Providing full holistic advice on an automated basis is not an easy task. It’s a path full of treacherous, technical hazards and it isn’t something that's possible straight out of the gate. We needed to be confident in our advice and to gain this confidence, we started with the areas of digital advice which were easier to deliver.

This was our starting point and we've strived to continuously add to this. You need to be clear on what your starting point is and where you want to end up.

The future of Multiply

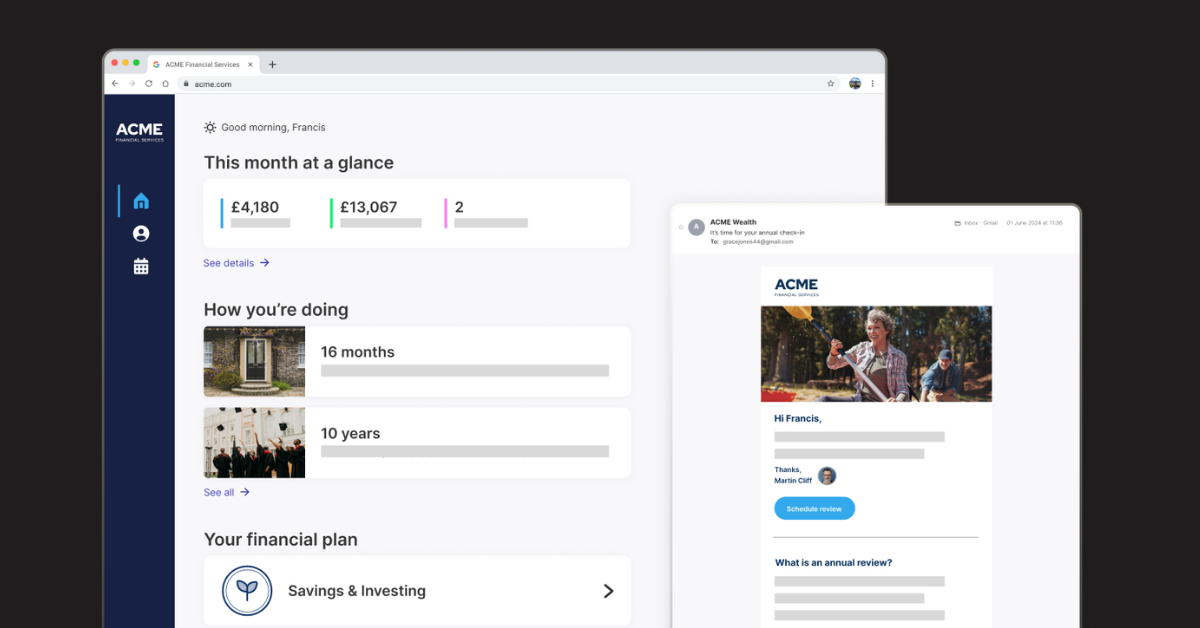

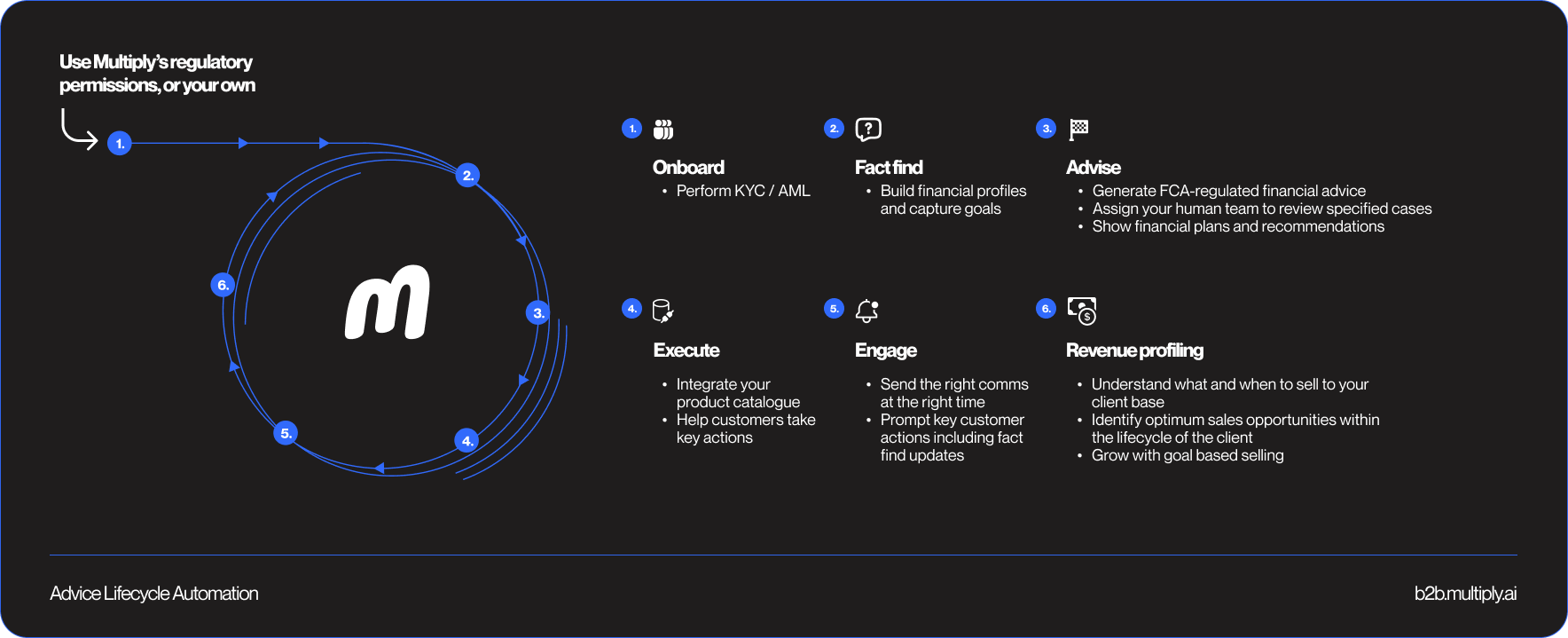

After three years spent giving financial advice through our consumer-facing app, it’s fair to say we’ve learnt a lot. That’s why we’re now partnering with other businesses to help them launch their own digital and hybrid advice propositions.

We can help with everything from creating fact-finding solutions to helping you generate your own advice. Whether you want the full advice lifecycle automation package or just some of our capabilities, we can cater to your needs.

In today’s tough economic climate, closing the advice gap is more important than ever and we want to share all our technology and expertise, to bring financial advice to even more people.

So, if you’re interested in discovering how your business could work with Multiply or you just want to find out more about our backstory, drop me a line at vivek@multiply.ai or book a demo on our website.