Are advisers missing an important point of Consumer Duty?

With Consumer Duty (CD) being a headline subject in many of the news articles and seminar invites that pass over my desk, it got me wondering if we advisers are missing a core point within the CD requirements, especially when I look back to the end of 2012 when we were all scrabbling around putting the final touches to our post-RDR propositions.

RDR was broadly successful in splitting out the various charges and making our ‘adviser charges’ clear to the customer, but did it do much to improve ‘fair value’? I’ll stick my neck out here and question whether, for many firms, the ‘pre-RDR’ commission-based world was largely replicated within a fee structure.

Of course, the regulator won’t set our fees, but they now expect us to demonstrate how our fees are reasonable for the client's benefit; i.e. they offer fair value. I believe that for advisers, this can be a tricky area because it is not simply a mathematical equation. I am the first to shout out ‘What price do you put on a client’s ‘peace of mind’ when making an investment decision?’ Or ‘What price is reassurance worth when you are sitting explaining the impact of a market fall on an investment?’. Yes, these do have value and our job is to demonstrate this, whether this is via post-advice surveys or a better recording of personal recommendations.

However, what probably concerns me most is whether adviser firms are paying much attention to potentially reducing fees or focussing on justifying what they currently charge. Maybe the reality is that we need to go through the justification process before we investigate how we can lower fees.

Since joining the financial advice world in 1995, it has always struck me how slow advisers are to embrace technology. Even today, many advisers still see it as a threat and I hear some say ‘people buy people, not machines’. I hear you and to a degree, I agree, but I also see a generation of potential customers who want to do more for themselves or want services that they can call upon when it suits them, even if it's 1am in the morning! I also see an ever-widening advice gap based simply upon the ‘cost of advice’ and I can’t see how firms demonstrating current charges for CD purposes will do anything for this latter area!

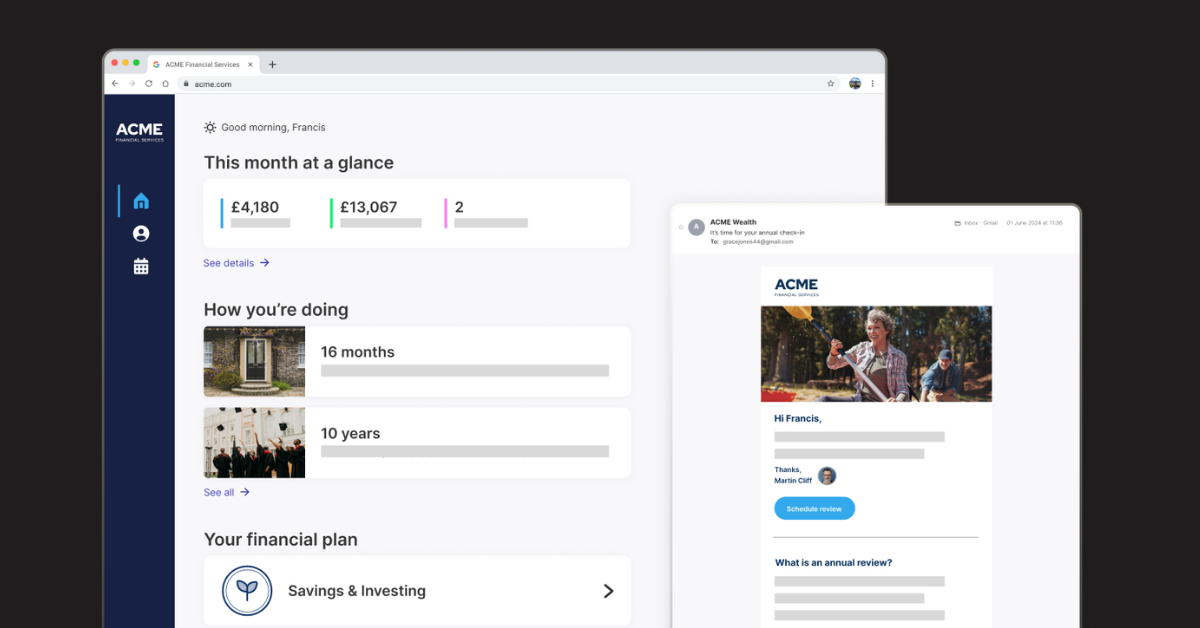

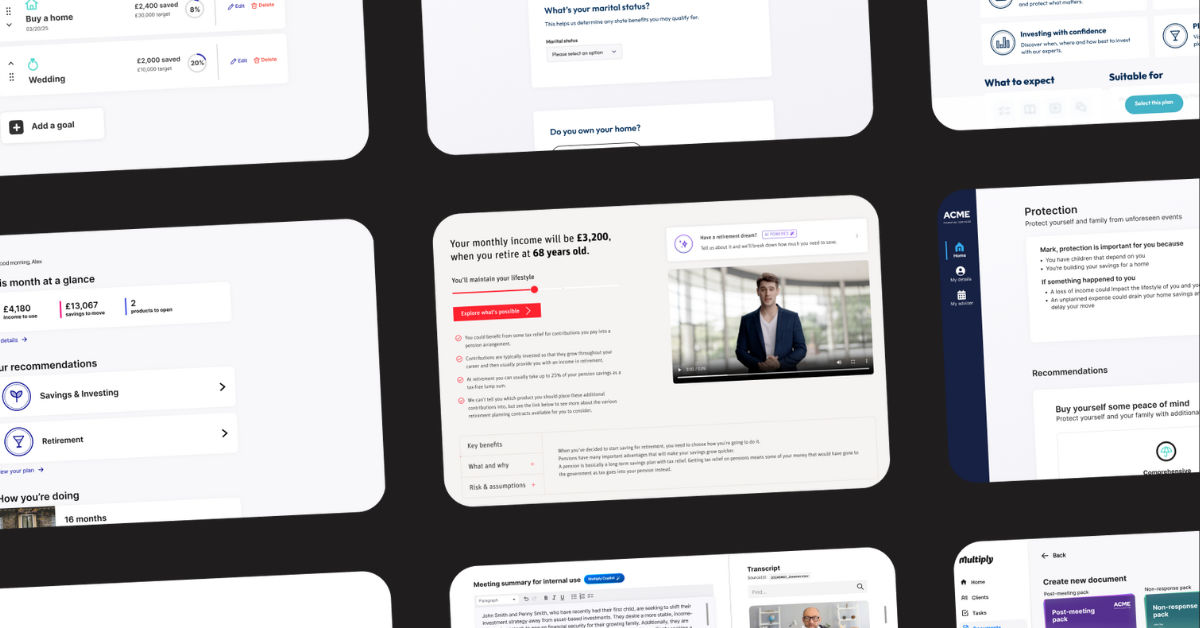

Technology in the industry has evolved to the point, where not only fully automated guidance or advice services can be offered, but hybrid solutions are also available. A hybrid solution puts both the client and the adviser in the cockpit, meaning that the client can be more involved in the process and when it suits them, the adviser ultimately remains in the captain’s seat controlling the process and advice being given but uses technology to do more of the heavy lifting, such as the analysis and advice formulation, the advice presentation, suitability letter and even more of the implementation and ongoing services. To me, this is what offers the opportunity to improve the service provided and also potentially reduce the fee for the customer.

It won’t happen overnight, but I really urge adviser firms to investigate how they can reduce customer fees and not simply justify the current fee structures.