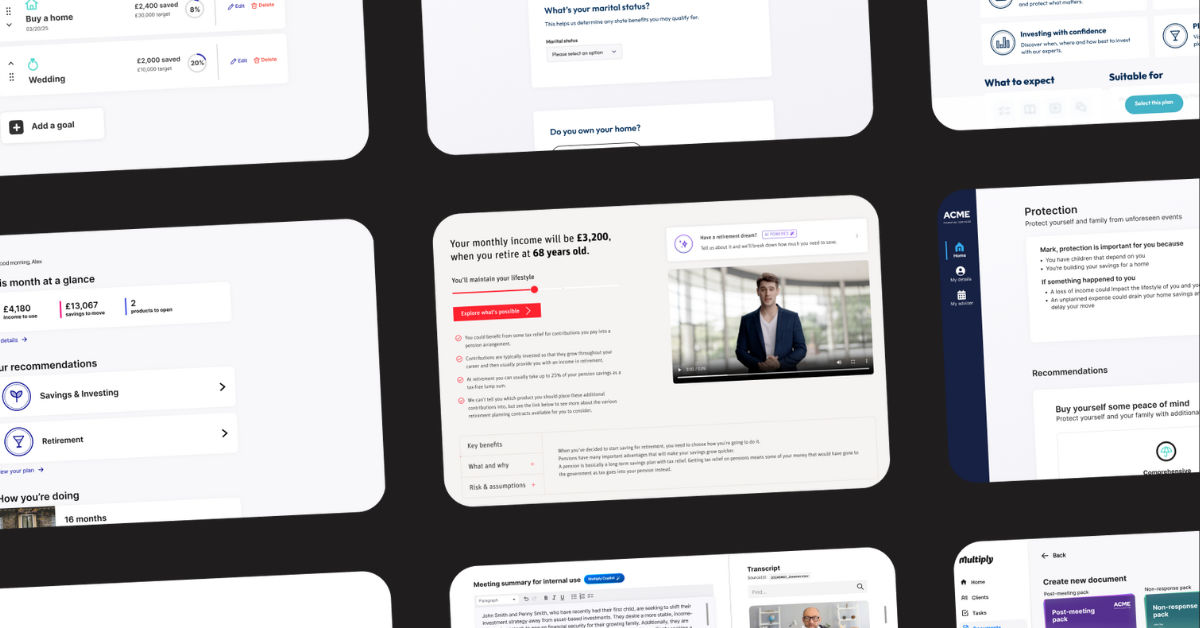

How Multiply enhances the customer experience with hybrid financial advice

In today's financial advisory sector, the primary focus is improving the customer experience. An innovative solution rapidly gaining traction is the use of hybrid financial advice, which combines the strengths of human advisers with automated technology. At the forefront of this trend is Multiply, offering a transformative platform for hybrid financial advice.

Understanding hybrid financial advice

Hybrid financial advice seamlessly merges human expertise with automated, digital advice systems. This approach empowers clients to benefit from the personalised insights of human financial advisers while enjoying the efficiency and accessibility of digital solutions. It is the perfect response to an increasingly digital world that still values human connection and personalised advice.

The role of Multiply in hybrid financial advice

Multiply plays a pivotal role in facilitating hybrid financial advice. Our platform integrates human interaction with digital interfaces, providing financial institutions with a robust tool to elevate their advisory service. It expertly guides clients through their financial journeys, with the opportunity for human advisers to step in when personal reassurance is required.

Benefits of hybrid financial advice for customers

The hybrid approach brings numerous advantages. It personalises financial advice, tailoring solutions based on a deep understanding of individual client's financial situations and goals. It offers unmatched accessibility and convenience, thanks to the digital component, making advice available anytime, anywhere. Hybrid advice also empowers customers, equipping them with the necessary information to make informed decisions. Additionally, it instils a sense of trust and credibility, as clients can engage with human advisers for complex financial matters.How multiply enhances the customer experience with hybrid advice

Multiply's hybrid financial advice model has a transformative effect on customer experience. Our platform's user-friendly interface and straightforward advice process simplifies the customer journey. Human advisers can intervene at key decision points to provide clarity and reassurance.Based on data from our consumer app, we noticed that customers were typically able to digest the digital information provided and could nearly finalise their financial decisions on their own. Yet, they often desired the added comfort of discussing their financial options with an adviser before finalising their product choice. This consultation simply gave them the confidence boost needed to make their already almost-formed decisions official.

With Multiply, customers can enjoy the convenience of digital advice, backed by the comfort of human interaction, all within a single platform. The need to choose between impersonal robo-advisers and expensive human advisers is eliminated.

Moreover, our platform leverages advanced algorithms to deliver tailored financial advice, increasing the relevance and positive impact of the advice given.

The future of customer experience with hybrid advice

The future of financial advice is undeniably hybrid. As advancements in AI and machine learning progress, the blend between human and digital advice will only become more refined. Multiply continues to invest in its platform to remain at the cutting edge of these advancements, ensuring customers continue to receive the best hybrid financial advice.In an industry that continues to evolve, Multiply is leading the charge with its innovative hybrid advice solution. By combining the efficiency of technology with the personalised touch of human interaction, we are enhancing the customer experience in financial advisory services.

Experience the benefits of hybrid financial advice with Multiply today! Book a demo to learn more.